Ramadan Kareem.

Another weekend is upon us. But not before Contra, the global freelancing platform, shocked the world by launching Contra Payments, a feature that allows humans to sell to agents. As agentic AI adoption scales, more people will create AI assistants in their likeness to handle critical tasks like evaluating options and making purchases.

A former colleague once argued that it won’t be long before AI agents start appearing in the total addressable market (TAM) slides of founders’ pitch decks. Maybe this is the signal.

In other news, OpenAI is fanning the flames on Advertising GPT, hinting at a future where brands can generate, test, and optimise ad campaigns directly inside ChatGPT. Fingers crossed and eyes open.

Remember, there are still open promotional slots up for grabs on Headlines by TechCabal. Headlines is a video-based talk show that explains the stories shaping African tech, policy, and enterprise. Partner with us for thoughtful brand placement that earns attention, backed by TechCabal’s distribution.

Talk to our partnerships team to explore sponsorship options.

If you haven’t seen Headlines by TechCabal yet, our last episode is available on YouTube here.

Features

Quick Fire  with Feranmi Ajetomobi

with Feranmi Ajetomobi

Feranmi Ajetomobi has spent the better part of a decade in the quiet trenches of Nigerian fintech and consumer markets. He cut his teeth leading growth at Cowrywise, where he helped build saving habits in a place where saving is anything but habitual. He then joined Flutterwave to drive lifecycle marketing during its explosive phase, learning firsthand how rapid scale amplifies the opportunities and complexities of human behaviour around payments and money movement.

- Explain what you do to a 5-year-old.

- What is the most unconventional thing about your career in Growth?

- What’s one growth win you’re proud of that most people would consider “boring”—but you know was everything?

The toys that you get require money for payment. I am the guy who ensures your parents can afford that payment by getting customers to buy what their companies sell. I spend a bulk of my day finding new ways to get those customers, ensuring they buy, and nurturing them so they come back to buy again.

I have never taken a professional course on marketing or growth. However, I have created course outlines to teach professionals how to market products. Does this mean courses aren’t needed? Absolutely not! I read the most random little things that cover for not taking those courses. Also, I plan to do my PhD in behavioural psychology, so please take courses.

Building product education flows at Cowrywise and every other place I have worked. I have seen customers who have never ever transacted, after an email or push notification, respond and start transacting.

In one of many cases, the customer had signed up over a year ago, but only decided to become active after receiving a product email from a marketing flow we did. It was funny, but it reminded me of one simple thing I learnt, “There is no silver bullet for growth, what wins every time is consistency with the good stuff.”

We are expanding across Africa!

Fincra is expanding across Africa, building the financial infrastructure that powers Africa’s cross-border payments. Build with us. Explore open roles.

trading

Kenyan bourse is creating a tech board to woo startups to list

The Nairobi Securities Exchange (NSE), the agency responsible for providing a trading platform for listed securities, is planning to establish a dedicated technology board designed to woo venture-backed startups onto public markets.

The exchange has long been dominated by banks and telecom firms; now, it wants companies like M-KOPA, BasiGo, and other high-growth venture-backed startups on its board. The proposed board would sit within NSE’s current structure but be tailored to fast-scaling companies that don’t yet look like blue-chip companies.

Why now? Kenya has built a reputation as East Africa’s tech capital, but very little of that startup energy shows up on the trading board. In 2018, the NSE launched Ibuka, a programme designed to prepare companies for listing by improving financial reporting and investor readiness. While Ibuka strengthened corporate discipline, its uptake has been slow, and it hasn’t translated into any listings. This time, the NSE wants to change the perception that only mature companies belong on its bourse.

Will startups bite? In 2022, the Nigerian Exchange Group (NGX) created a dedicated technology board to attract high-growth tech companies; however, it has yet to attract any listings. Analysts have pointed to governance readiness gaps, valuation mismatches, and concerns around initial public offering (IPO) liquidity. But Nairobi insists liquidity isn’t the problem in the Kenyan market, but mobilisation is.

Why this matters: Public markets offer startups long-term capital and local retail ownership, yet it still comes with heavy public scrutiny.

For VC-backed companies, listing on the public market can give a sort of reprieve to investors seeking liquidity events to exit the business. Still, startups will only list if rules, valuations, reporting demands, and liquidity realities align with or surpass the comfort of their VC realities.

The Smarter Way to Save

Earn up to 20% interest on your savings with PalmPay. Join over 40 million users building smarter saving habits with simple, automated tools designed for everyday life. Learn more.

telecoms

MTN Group pledges job stability in IHS buyout

When big acquisitions happen, employees get nervous about potential layoffs. Well, not for IHS employees.

As part of its move to fully absorb IHS Towers, MTN Group, the telecom giant, is offering at least 12 months of guaranteed pay and core benefits for IHS staff once the estimated $2.2 billion deal closes.

Under MTN’s safety net: According to documents filed with the US Securities and Exchange Commission (SEC), IHS employees are guaranteed at least 12 months of pay and core benefits, which they currently receive. That means their base salaries stay intact, and short-term incentive structures would not be tampered with.

Their health and retirement benefits will also remain unchanged, and employees will not lose their tenure during the transition period. Also, share awards are being turned into cash or retention bonuses, so employees don’t lose out when the company changes hands.

Why so many job promises? In February, Nedbank Group, South Africa’s fourth-largest commercial bank by assets, promised to retain all current NCBA employees following the acquisition. Big African acquisitions are increasingly coming with public reassurances because ripping out teams immediately can be more expensive than keeping them.

Is this pure generosity? Not quite. A part of acquiring a new company is restructuring, and that is easier when the engineers stay put. Offering a 12-month cushion reduces the risk of high talent turnover or operational disruption.

Get the Nimbus Aid Foundation’s 2025 Impact Report

Nimbus Aid Foundation’s 2025 Impact Report shows how ₦50M in DOOH advertising transformed 33 women-led businesses, driving 65% traffic growth and moving beneficiaries from pre-revenue to post-revenue. Download here.

insights

Funding Tracker

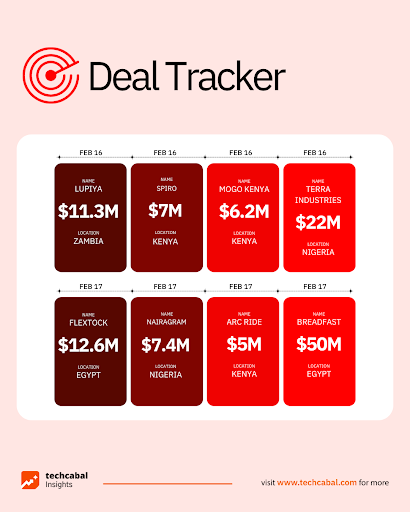

Breadfast, an Egyptian e-commerce startup, secured $50 million in a pre-series C funding round. The funding was backed by Ubadala Investment Company, International Finance Corporation, Olayan Financing Company, with participation from Y Combinator, Novastar Ventures, 4DX Ventures, European Bank for Reconstruction and Development, and others. (Feb 17)

Here are the other deals for the week:

- Lupiya, a Zambian fintech startup, raised $11.25 million in series A funding led by IDF Capital’s Alitheia IDF Fund, with participation from INOKS Capital and German development finance institution KfW DEG. (Feb 13)

- Spiro, a Kenyan e-mobility startup, raised $7 million in debt funding from Nithio. (Feb 16)

- Mogo Kenya, a Kenyan fintech startup, raised $6.2 million in debt funding from a bank syndicate led by I&M Bank and Ecobank. (Feb 16)

- Terra Industries, a Nigerian defence tech startup, raised $22 million in a funding round led by Lux Capital, 8VC, Nova Global, and Silent Ventures. Other investors include Belief Capital, Tofino Capital, and Resilience17 Capital, as well as angel investors including Jordan Nel and Hollywood actor Jared Leto. (Feb 16)

- Flextock, an Egyptian logistics startup, raised $12.6 million in a series A funding round led by TLcom Capital, with participation from Conjunction Capital, Capria Ventures, and other strategic investors. (Feb 17)

- Nairagram, a Nigerian fintech startup, raised $7.4 million through a commercial paper program from undisclosed investors. (Feb 17)

- Arc Ride, a Kenyan e-mobility startup, secured a $5 million commitment from the International Finance Corporation (IFC). (Feb 17)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, take a closer look at how informal healthcare providers are quietly sustaining Nigeria’s health system. Read more here.

Join the second edition of The Citizen Townhall

Tech is political!

Political decisions shape and reshape the tech landscape every single day. So here’s the big question: Who gets to shape our lives and what can we do about it?

That’s the conversation we’ll be having at the second edition of The Citizen Townhall; on February 28, in Lagos. Join the conversation. Register now for FREE.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $67,974 |

+ 1.81% |

– 24.45% |

|

| $1,959 |

– 0.40% |

– 34.62% |

|

| $1.42 |

+ 0.87% |

– 25.97% |

|

| $83.45 |

+ 2.17% |

– 35.03% |

* Data as of 06.48 AM WAT, February 20, 2026.

Events

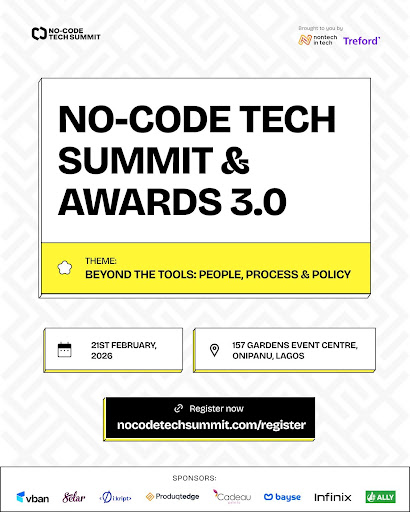

- No Code Tech Summit 3.0, the flagship gathering for Africa’s no-code and non-technical tech ecosystem, returns to Lagos, Nigeria, on February 21. Themed “Beyond the Tools: People, Process and Policy,” the summit will shift focus from software platforms to the talent, operational systems, and regulatory structures shaping long-term industry growth. Convening founders, professionals, executives, and career transitioners, the event will feature keynotes, panels, masterclasses, and curated networking sessions designed to advance collaboration beyond traditional coding roles. Buy tickets to attend the summit.

- East Africa’s digital economy is scaling fast, but cyber resilience isn’t keeping up. On February 26, in Nairobi, Smartcomply will host The Secure Horizon Executive Breakfast, an invitation-only forum bringing together senior leaders across finance, fintech, tech, and regulation to confront the widening gap between AI-driven growth and operational security. The closed-door gathering will feature keynote insights on AI-accelerated cyber risk, a regulatory fireside chat, and the launch of a new research report developed with TechCabal Insights, exploring how evolving threats are reshaping East Africa’s digital trust architecture. Learn more and register here.

Written by: Success Sotonwa, Opeyemi Kareemm and Emmanuel Nwosu

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

Comments

Post a Comment